Back to employers

Accounting

What comes to mind when you think of accounting careers? Many people would answer something along the lines of ‘calculations,’ ‘finances,’ or ‘numbers on paper,’ but the reality of this career path is something far more exciting.

From helping local community members start their dream businesses to guiding international corporations through new and costly projects, your life as an accountant will never be boring! What’s more, there are tonnes of specialisations that fall under the accounting umbrella, so you can tailor your career to your unique strengths and interests.

Some of the exciting accounting avenues you can explore are:

- Environmental Accounting

- Forensic Accounting

- Government Accounting

- Managerial Accounting

And trust us, that’s not all!

Defining Accounting

Before delving into accounting job opportunities and insights into what life in this industry could look like, it’s important to establish a firm understanding of what accounting actually means.

In short, accountants are essential in every industry, they help people and businesses reach their financial targets with their savvy money management and strategic skills. How they support their clients varies based on the needs of the client and the accountant’s specialisation.

Imagine a day as an accountant where you’re managing budgets for a cool tech startup, diving into the finances of a popular fashion brand, or sorting out expenses for a hit music label. So, if you didn’t think accounting was a dynamic job, it’s time to think again!

Accounting in Australia

Another compelling benefit to pursuing an accounting career is that you’ll enjoy a heightened level of job security (and did we mention accounting salaries are pretty sweet, too?).

According to Chartered Accountants ANZ,

“Accounting, audit and finance professionals in Australia are currently in shortage and, in the absence of change, shortages will persist and grow into the future.”

While this sounds like bad news, it’s great for aspiring accountants, as the lack of competition makes it easier for newbies to break into the industry. However, that doesn’t mean that you don’t have to try your best; you won’t land a fancy, high-paying role by cruising through your studies!

There are tonnes of ways to kickstart an accounting career, regardless of whether you’re planning on attending university or signing up for a TAFE course. In fact, there’s nothing stopping you from getting started today!

What You Could Do

One of the best parts about an accounting career is the extensive range of specialisations you can choose from (and the exciting accounting pathways that lead to each). Regardless of your interests, you’re almost guaranteed to find your perfect role; all you need to do is look!

To get you feeling inspired, we’ve compiled a list of five exciting accounting job opportunities. However, it’s important to note that this isn’t an exhaustive list. If these accounting pathways aren’t quite to your liking, simply keep looking! There are tonnes of other options out there in any industry you’re passionate about.

Audit

The term ‘audit’ refers to the process of looking at and verifying a company’s financial records to make sure that everything is being reported accurately. Under the auditing umbrella, there are three different categories: external, internal, and government. If you’re working as an auditor, you’ll be executing external audits as an unbiased third party who’s outside of the company in question.

Those who choose to specialise in auditing will be ensuring that organisations operate fairly and identifying growth opportunities; it’s an incredibly important and rewarding avenue!

Corporate Finance

In short, corporate finance careers involve dealing with a corporation’s capital structure, which relates to funding and actions that could increase the company’s value. Those working in this field will plan and implement initiatives and resources while taking into account any potential risks.

If the idea of advising on investments and transactions, doing due diligence, structuring transactions and being involved in tonnes of other exciting processes piques your interest, the world of corporate finance could be perfect for you!

Advisory Roles

Accountants working in advisory roles help their clients achieve financial and operational goals by providing expert opinions. Their responsibilities include cash flow forecasting, tax planning, and a bunch of other important financial topics.

If you like seeing others succeed (and are well-known for giving fantastic advice), an advisory role might be a great fit. All you need is some in-depth knowledge about financial planning, analytics and industry knowledge, and you’ll pick that up in time.

Tax

If you’re already a member of the workforce, you’ll already be well acquainted with the ATO, MyTax and the concept of tax returns. If you choose to specialise in tax accounting, you’ll be helping individuals and businesses with the preparation of tax returns and tax payments so they aren’t owed (or owe the government) any extra dosh.

Taxation teams also advise on income, capital gains, international transactions and employment taxes. In short, it’s a dynamic and varied job that can prove super rewarding!

Wealth Management and Wealth Protection

Want to rub shoulders with the top 1%? Accountants going into wealth management and wealth protection work with affluent clients to ensure that they stay affluent. Usually, clients will have a minimum of two million in assets before enlisting the help of a wealth manager.

Those in this specialisation work on projects related to financial planning, investment management, insurance sales and estate planning. Essentially, the ultimate goal of a wealth manager is to help others increase their wealth and protect it over the long term.

If you want to discover even more, head over to Forbes’ article describing 8 Types of Accounting.

Graduate Employment and Gender Split

While we love to highlight alternative career pathways for job hunters who don’t resonate with the idea of attending university, those pursuing an accounting career will likely need to lock down a Bachelor of Accounting, an undergraduate in finance, economics or business, or a TAFE qualification. Accounting qualifications are extremely important because you’ll need to join a professional accounting body and complete an accreditation program if you’d like to become a Chartered Accountant or practising accountant.

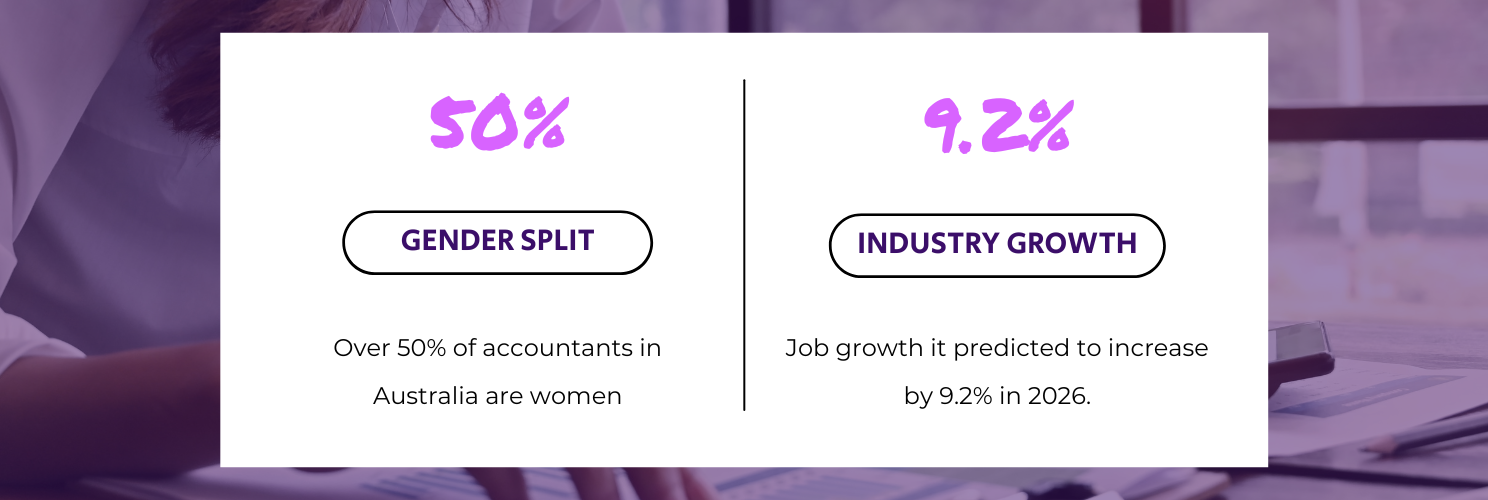

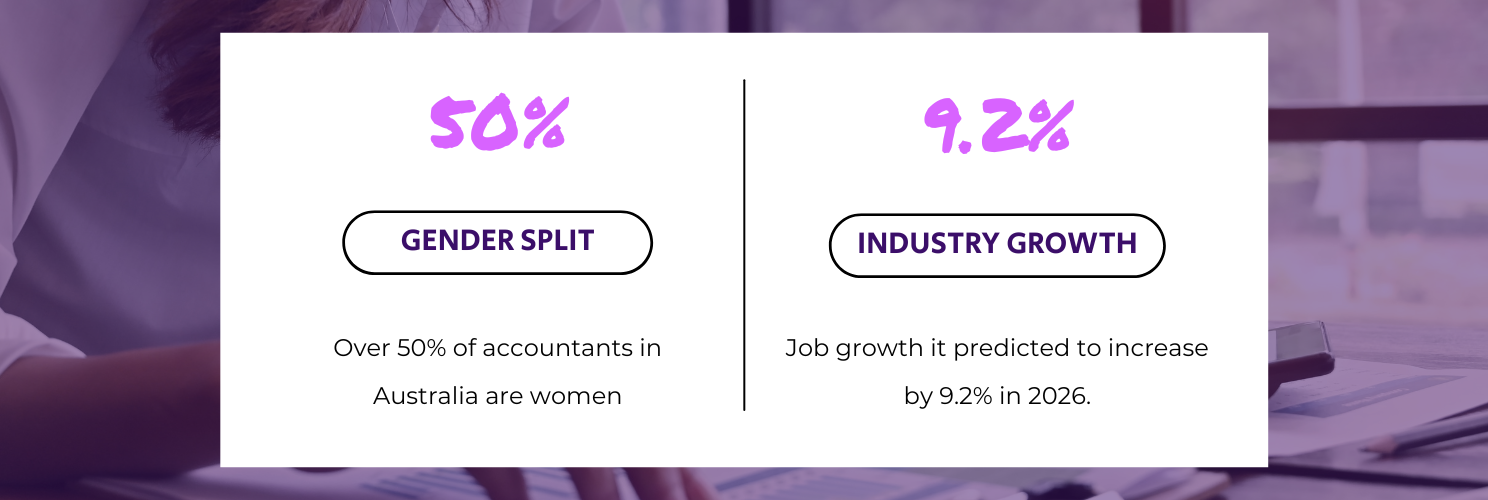

However, some may say this is well worth it, as Australia already has a high demand for accountants, and job growth is predicted to increase by 9.2% by 2026. This means that university graduates will likely find it less difficult to find an accounting job, even in today’s competitive job market.

Gender Split

Women are breaking down barriers and smashing stereotypes in accounting careers, which we at Explore Careers absolutely love to see! In fact, the Association of Chartered Certified Accountants, otherwise known as ACCA, states that women account for 46% of all accountants in the UK, and in Australia, the number is even higher. Accountants Daily states that over 50% of accountants in Australia are women; talk about girl power!

Average Salary

As in any role, accounting salaries can vary depending on one’s role and experience in the industry. However, we’ve managed to track down some pretty impressive average salaries for full-time accounting roles across Australia:

- The average Australian accountant makes $94,965 per annum, which translates to about $48.70 an hour

- Entry-level accounting salaries start at $79,581 per annum

- High-level accounting salaries can reach up to $120,000 per annum

Those are some general numbers, but if you want to know what accounting salaries specific types of accountants earn this will give you a better idea:

- Assistant Accountant | $75,435 – $92,555

- Senior Accountant | $115,025 – $141,775

- Group Accountant | $119,840 – $155,150

- Corporate Accountant | $119,840 – $155,150

- Project Accountant | $109,675 – $146,590

- Accounts / Finance Officer | $70,085 – $87,740

With these numbers in mind, it’s easy to see that an accounting salary is a competitive one. However, it’s important to remember that these numbers can be affected by experience, skill level and education. In other words, you might have to work your way up to the big bucks!

Qualifications and Entry Pathways

When entering the exciting world of finance, the one most important step to launching your career is earning your accounting qualifications. After all, you can’t legally work unless you’re qualified!

To earn all the necessary accounting qualifications and learn core accounting skills that you’ll need for years to come, you have a couple of options:

TAFE Courses

If you don’t feel particularly enthusiastic about university-based learning, it’s possible to become an accredited accountant through TAFE courses. There are a variety of courses available on the TAFE Courses website that will provide you with all the accounting qualifications necessary to get started (and some even allow you to complete all your work from home)!

University

The classic university pathway is probably the most common course of attack for aspiring accountants. While you’re at university, you can also apply for student programs with local accounting firms to kickstart your career early and begin working towards a permanent position.

If you’re unsure where to attend university and earn your accounting qualifications, here are the Australian universities ranking highest for their accounting courses:

- University of Melbourne

- Monash University

- University of Queensland

- Victoria University

- University of Sydney

And these are the courses you could consider:

- Diploma in Accounting

- Bachelor of Commerce, majoring in Accounting

- Graduate Certificate in Professional Accounting

- Master of Commerce, majoring in Accounting