Back to employers

Banking, Insurance & Finance Industry

The banking, insurance and finance sector is massive and intertwines with almost every single other industry. Essentially, what this means is that the financial services industry is vast, dynamic and offers plenty of diverse finance jobs and opportunities! Contrary to popular opinion, jobs in the financial service industry are so much more than sitting in a stuffy cubicle whilst punching numbers into a dusty calculator. In fact, you could be working in any industry you like while enjoying great pay and an exciting role to boot!

So, What Is the Financial Services Industry?

If you’re not entirely sure what the financial services industry is, you’re not alone. However, despite the mystery surrounding it, its definition isn’t as complicated as you might think!

In short, those working in the financial services industry aid in the responsible management of money for individuals, businesses, and governments. Roles within the banking and financial system also oversee the circulation of money, managing investments, and the lending of funds. Still in need of a little extra clarification? Here’s a little breakdown of the three core areas:

Those who occupy banking jobs help individuals and businesses manage their money. However, there are tonnes of different banking jobs to choose from that offer unique and exciting responsibilities. It’s all about figuring out what banking careers are available and where you want to end up in the financial services industry!

Learn more

Finance is potentially the broadest sector of the financial services industry and encompasses tonnes of different finance jobs to help individuals and businesses better understand money. By choosing a career in finance, you’ll be responsible for keeping the money of others safe, handling debt, providing guidance and helping others manage their financial futures!

In fact, finance careers are so broad that you could work across any of these three areas:

- Personal (Helping individuals)

- Corporate (Helping businesses)

- Public (Helping government organisations)

Learn more

Like banking jobs, insurance careers fall under the financial services industry. However, instead of helping others manage their money, insurance professionals protect the existing investments of individuals and businesses by selling and managing insurance policies. If you ever wanted to insure your house against fire, theft, or any other kind of damage, those with insurance careers would be your first point of contact!

Learn more

Accountants play a crucial role across all sectors, assisting individuals and businesses in achieving their financial goals through expert money management and strategic insights. The ways in which they assist their clients depend on both the client’s specific requirements and the accountant’s area of expertise.

Learn more

Insights into the Financial Service Industry

According to the Australian Government, there are currently over 540,000 workers in the financial services industry in a variety of exciting roles. In fact, the banking, finance and insurance industry is the 11th largest employer in Australia! From Banking Administrators and Advisors to Investment Managers, Accountants and Financial Directors, the financial services industry truly has something for everyone!

What’s more, moving into a banking job or finance job gives you the power to work with any kind of business you like. Every organisation has a finance department, meaning finance careers can get you working with some of the biggest companies out there! With its many entry pathways and professional opportunity offerings, the financial services industry sure has a lot to offer.

Discover Trends in the Financial Services Industry

When you’re looking to join a thriving sector, like Australia’s Financial Services Industry, it’s helpful to be aware of trends and patterns. This way, you’re not only up to date on developments within the industry, you’re also well aware of what kind of skills recruiters look for when hiring for finance careers and banking jobs!

Industry Developments

Aside from hiring trends, the financial and banking sector has also been identified as being most likely to be impacted by emerging technology (often referred to as FinTech). This will present additional career opportunities that blend the finance and tech industries (so brush off those IT skills if you can)! According to the Oxford Economics report Technology and the Future of Australian Jobs: What Will Be the Impact of AI on Workers in Every Sector? financial and banking organisations are also placing greater emphasis on improving customer service, and will invest more in automation, analytics and customer interaction technology to empower employees to continue to deliver in their roles and grow professionally.

As the financial services industry grows, so will the technological advances, and new professionals will need to be prepared to keep up to date with the latest technology skills.

Hiring Trends

In regard to hiring trends, it’s reported that finance recruiters value skills such as accounting, analytical thinking, financial decision-making, management, financial reporting, communication, and investing. This highly sought-after blend of hard and soft skills will allow you to thrive across a range of different and exciting finance careers, and if you begin learning them before you enter the workforce, you’ll be well set-up for a successful career!

While the most in-demand finance careers can vary due to economic conditions and industry trends, it’s important to keep up to date with what recruiters are hiring for. Currently, roles such as Financial Analyst, Accountant and Investment Banker are incredibly popular in Australia, so those pursuing pathways to those positions can benefit from increased job security and more opportunities.

It is also important to familiarise yourself with Australia’s ‘big four,’ which are the largest financial organisations that offer the most employment opportunities. For those unfamiliar, these include Commonwealth Bank, Westpac, National Australia Bank, and Australia and New Zealand Banking Group (otherwise known as ANZ).

These organisations have strong early career and graduate entry pathways into the financial services industry and are a great starting point for those wanting to launch finance careers.

Gender Split

Across Australia’s financial services industry, the gender split is remarkably even. However, women are being paid less than men. Drivers of this pay gap can include:

- More men in leadership roles, more women in more junior roles.

- More men in higher-paid jobs, women in lower-paid jobs.

- Unequal participation in part-time work.

- Inequality in employee movements

In order to close the gender gap in the financial services industry, we need more women working their way through the ranks and pursuing high-level roles in banking. Essentially, we’re telling you to be the change you want to see in the financial services industry!

Qualifications and Entry Pathways

One of the best things about a career in finance is that there are so many different ways to land your perfect finance job, regardless of whether you’re a school leaver or a graduate!

One option is to attend university first and then apply for a graduate programme that’s relevant to the financial services industry. However, if university isn’t for you, you could also choose to complete a professional qualification through TAFE, or even jump straight into the workforce after year 12! This final option allows you to start earning and learning whilst completing a school-leaver, traineeship or apprenticeship program!

Degrees for Banking, Insurance & Finance Careers

If you’re not quite sure which area of the financial services industry you want to land a job in, choose degrees and universities that are valued across all sectors! The following are perfect choices for aspiring finance pros who want to expand their job prospects:

Bachelor of Commerce

This three-year course where you’ll learn all about real-world business operations and have the opportunity to specialise in exciting topics like Business Economics, Cyber Security Management, Finance and Marketing! Trust us, this degree will have you ready to launch an incredible and successful banking career.

Bachelor of Finance

As you might expect, studying a Bachelor of Finance would set you up perfectly for jobs in the financial services industry! Commit to this three-year course and learn all about corporate finance, equities and investments, debt markets and fixed income securities, financial modelling and international finance!

Where to Study:

Choosing the right university to launch your finance career is super important. After all, you’ll be spending three or more years studying there, so make sure it’s right for you! The following are some Australian Universities with great programs for aspiring financial services industry professionals:

Alternative Qualifications and Entry Pathways

Alternative Qualifications and Entry Pathways

Even if you aren’t looking to complete a three-year degree, you still have a few qualification options that could help you land exciting banking jobs! To start exploring your (many) options, check out the TAFE courses below and see if any of them get you excited:

Certificate IV in Business Finance

This handy Business Finance certification is bound to kickstart your banking career, and the best part is that there are no entry requirements whatsoever! Take this course to master office administration, financial reporting and payroll management; essentially, to learn all the skills you need for a successful career in the financial services industry!

Diploma of Quality Auditing & Business (Compliance)

If you want to complete a course that will help you get into any kind of business environment, including banks, consider taking on the Diploma of Quality Auditing and Business (Compliance). In addition to teaching you technical skills, the qualification provides you with all the skills and tools necessary to interpret compliance requirements and ISO standards to lead quality audits while placing a focus on communication and enhance transparency between departments and staff! This is a great option to get your foot in the door and infiltrate the financial services industry.

Banking Careers

What Could You Do:

Thinking of pursuing a banking job? Great idea, but what kind of banking career will you pursue? To help you feel inspired, check out the examples listed below!

Banking Jobs:

Banking Trader: As a key part of the financial services industry, traders provide a variety of financial services to individual clients, companies, or organisations. They often provide advice concerning investments, as well as assistance in financial asset portfolio management. It’s fancy stuff!

Bank Manager: Bank Managers are responsible for the operational tasks of bank branches or similar financial institutions that sit under a banking organisation. They oversee operational functions and provide solutions to challenges and customer service, staff training, and promotional support of the bank in general. Essentially, it’s a very important banking job!

Mortgage Advisor: Some Mortgage Advisors work directly for specific lenders, such as banks, and advise potential clients and customers on their options available with that lender. This kind of banking job is great for budget savvy finance pros.

Investments:

Investment Banker: Investment Bankers advise, buy and sell assets on the financial markets to raise money for their organisation. It’s one of the highest-paid jobs in the financial services industry and is a highly competitive field (but don’t let that put you off, we know you’ve got this!).

Investment Advisor: Investment Advisors are subject matter experts; this means they help clients understand their options and provide guidance on best-case success so they can maximise their investment opportunities. This finance job requires a level head and a great understanding of stocks, so make sure you do your research!

Hedge Fund Manager: A Hedge Fund Manager is responsible for managing an investor’s capital, running the fund’s daily affairs, and managing ongoing investment decisions ensuring the best financial outcomes for their client. You’ve probably heard of this role before; it’s pretty popular in the financial services industry.

Do Banking Jobs Require a Degree?

While not all banking jobs require a degree, those who know that they want to pursue a finance career would benefit greatly from a bachelors, honours or masters degree. However, if you choose to forgo tertiary education, you’ll want to complete high school and focus on subjects such as mathematics, finance and commerce (at the very least).

Those who do take the university route have tonnes of exciting degrees to choose from such as:

Bachelor of Banking and Finance

Cover all the info you’ll need to excel in a banking career by studying a Bachelor of Banking and Finance! You’ll pick up all the knowledge you need on modern financial markets and banking operations, industry software, integration, regulation and risk of financial technologies, and much, much more!

Average Banking Salary

According to PayScale, the average base salary for bankers in Australia is a whopping 100k, and there are plenty of opportunities to earn even more! However, if you’re looking for a more concise list, check out exciting banking jobs and the corresponding average salaries below!

Bank Teller: $75,000

Credit Specialist: $85,000

Banking Advisor: $95,000

Client Relationship Manager: $100,000

Banking Manager: $125,000

Finance Careers

What Could You Do:

If you’re leaning away from banking careers and towards the broader area of finance (and, more specifically, accounting) that’s okay too! Start your journey towards a rewarding finance career by checking out a few examples of the types of roles you could pursue:

Financial Services

Financial Analyst: From banks, insurance providers, and stockbrokers, to retailers and the public sector, Financial Analysts look at investment markets, stocks, bonds, and hedge funds to help their organisation with financial planning. Their goal is to help the organisation make well-informed decisions that make the best use of resources to achieve company goals. This is a key role in the financial services industry that ensures the money-related success of others!

Financial Auditor: Financial Auditor is another finance career that revolves around identifying and assessing any risks which could have a significant impact on the financial performance of the organisation. They also make helpful recommendations on the measures needed to mitigate those risks.

Accounting

Accountant: Accountants are directly responsible for the financial affairs of their employers. Accounting covers a broad portfolio of financial work within a company, and there are tonnes of exciting roles to choose from! Whether you’re interested in audit, corporate, tax, or wealth management, there’s bound to be a perfect finance career in accounting that suits your needs.

Forensic Accounting: Forensic Accounting is another key subset of accounting that looks at issues resulting from actual or anticipated disputes; think of it as being a money detective! Forensic Accountants often have to give expert evidence at a trial so if you’re interested in blending your finance career with law, this is the perfect pathway for you.

Investment Accounting: As another (equally important) area of accounting, investment accounting describes the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund. This kind of role is super important within the financial services industry!

Do Finance Jobs Require a Degree?

Unfortunately, there’s no way around university if you want a finance career in accounting. However, the good news is that accounting degrees can be super fun! If you love juggling numbers, investigating finances, and putting together reports, the three years that it takes to become certified will fly by!

The same goes for finance careers, and particularly for roles such as Financial Analyst. However, you shouldn’t let this put you off. If you’re truly passionate about landing a finance career, it’s worth investing the time (and you’ll probably enjoy it, too)!

Those who decide to commit to university have tonnes of exciting degrees to choose from such as:

Bachelor of Accounting

Learn all the skills you need to set you up for an accounting career in the financial services industry by studying a Bachelor of Accounting! Offering practical knowledge through core studies in both accounting and law, this is the perfect education option for those who know they’re destined for accounting.

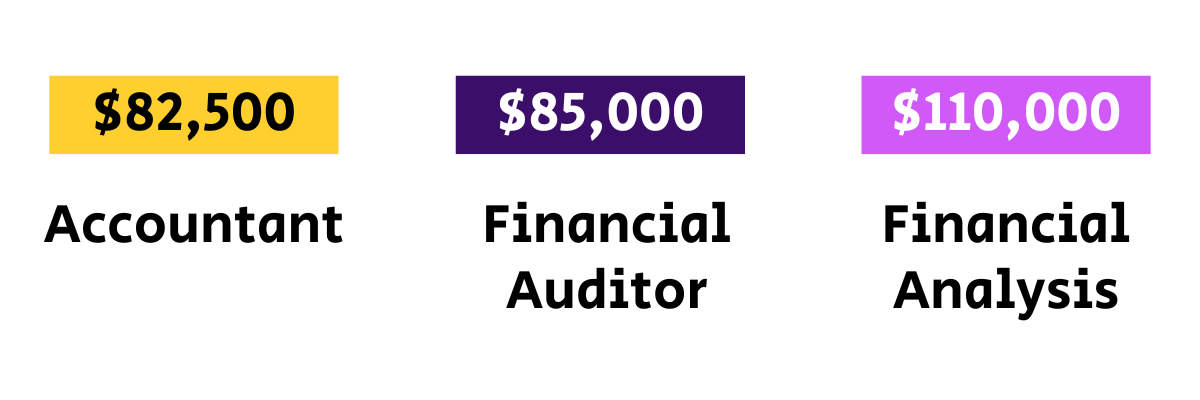

Average Finance Salary

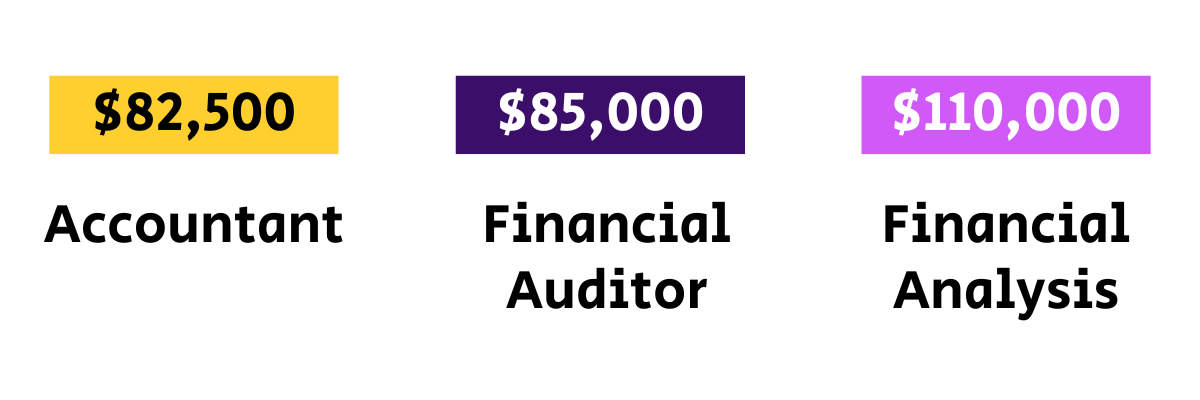

Wondering how much you’ll be earning? We’ve got you covered; check out the average salaries for a bunch of accounting and finance jobs below:

Accountant: $82,500

Financial Auditor: $85,000

Financial Analyst: $110,000

Insurance Careers

What Could You Do:

So, you’re interested in a career in the financial services industry, but you’re particularly interested in insurance careers? We think that’s a great choice! After all, you’ll be helping people protect their assets and remain in a good financial position even in the worst-case scenario!

To feed your interest in insurance jobs, we’ve compiled a list of some of the most popular ones; see if any of these appeal to you:

Insurance Broker: Insurance Brokers work with clients to help them understand and purchase the insurance they need. Unlike Insurance Agents, who work for insurance companies, Insurance Brokers work solely for individual clients, with their specific needs and interests in mind. This is a great insurance career for those who want to help people!

Insurance Agent: While the titles of Insurance Broker and Insurance Agent are often confused, there are some key differences between the two. For instance, while Insurance Brokers work solely with clients, Insurance Agents act as a liaison between insurance companies and clients. Those working in this role play a pivotal role in the financial services industry.

Do Insurance Jobs Require a Degree?

In short, no, you don’t need a degree to land an insurance career (but it can be helpful). If you know university isn’t for you, try your luck applying for entry level positions and work your way up within insurance companies. However, if you don’t mind a few years of study, there are tertiary pathways into an insurance career that can give you an edge against other candidates, such as:

Bachelor of Actuarial Studies

Studying a Bachelor of Actuarial Studies will provide you with incredibly powerful tools to succeed in your insurance career. Throughout the course, you’ll learn how to guide businesses, governments, non-for-profit organisations and individuals towards smart decisions for their futures. Trust us, a little study will be worth it for the skillset you’ll gain!

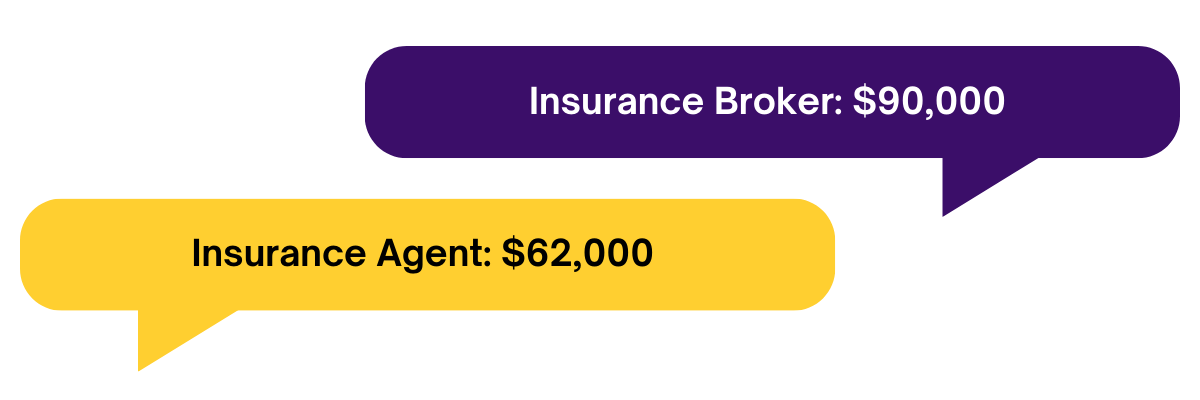

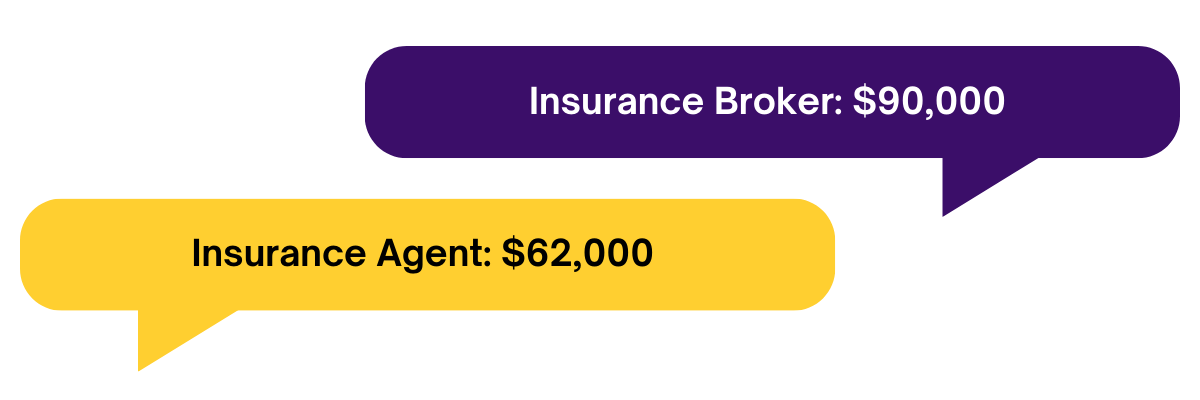

Average Insurance Salary

Wondering what those with insurance careers earn per annum? We’ve got you covered! Check out the impressive salaries from these popular jobs in the insurance industry:

Insurance Agent: $62,000

Insurance Broker: $90,000

Where to Learn More

You can find out more about the financial services industry through professional bodies and organisations that advocate for careers in the sector.

Some good places to start include:

And many more! Each state will also have several professional organisations that can help you learn more about the industry, network, and develop your career.

And if you like our advice on the financial services industry, you can also check out our blog posts on the topic!

Some great places to start are:

Ask Findex: How to Choose the Right Degree for you!

Approaching graduation and feeling unsure of what’s next? Findex has you covered with their guide to choosing the right university course for you!

Explore

Discover the Role of a Forensic Accountant

Looking to break into the exciting world of forensics but don’t know where to start? Discover the coolest job you never heard of: forensic accountants!

Explore

Alternative Qualifications and Entry Pathways

Alternative Qualifications and Entry Pathways